We collect prior payroll history from the current calendar year for every worker in order to accurately calculate paychecks that are created in our system. We also need that information in order to prepare and file payroll tax returns.

Kicking Off the Implementation

Prior to starting an implementation for an onboarding employer, please make sure the items below are completed:

- All workers (including terminated workers) have a worker profile

- The easiest way to ensure all worker profiles are created is to download the full year to date payroll report and cross-reference the worker list Paid

- Pay types have been added to the employer’s profile

- Benefits, Time off policies, and deductions have been added to the employer’s profile

- Confirmation of the employer’s pay group and desired first payroll run date based on their payment lead time [two day vs four day]

Please note: The desired first payroll run date should be at least five business days out from the date we receive all historical payroll data.

Required Reports and Data for Implementation

Payroll History Reports

The time of year an employer is transferring their payroll over will determine what check dates or date range of reports they need to provide:

| Joining in Q1 |

- Payroll by payroll breakdown per employee of wages, employee taxes, employer taxes, and benefits/deductions for all payrolls processed so far in Q1

|

| Joining in Q2 |

- Quarterly totals for Q1 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Payroll by payroll breakdown per employee of wages, employee taxes, employer taxes, and benefits/deductions for all payrolls processed so far in Q2

|

| Joining in Q3 |

- Quarterly totals for Q1 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Quarterly totals for Q2 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Payroll by payroll breakdown per employee of wages, employee taxes, employer taxes, and benefits/deductions for all payrolls processed so far in Q3

|

| Joining in Q4 |

- Quarterly totals for Q1 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Quarterly totals for Q2 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Quarterly totals for Q3 per employee that includes wages, employee taxes, employer taxes, and benefits/deductions

- Payroll by payroll breakdown per employee of wages, employee taxes, employer taxes, and benefits/deductions for all payrolls processed so far in Q4

|

Required Data for the above Payroll History Reports

Each payroll report for Check Dates and Date Ranges need to include the following:

| Check Date/Date Range |

- Check Date for the individual payroll runs of the current quarter

- Date Ranges for the past quarters

- Q1: 1/1-3/31

- Q2: 4/1-6/30

- Q3: 7/1-9/30

|

| Employees |

- Please ensure all employees, active and/or terminated, that were paid in the current calendar year are included in the reports

|

| Wages |

- Please ensure the wages are broken out by specific compensation types

- Ex. Hourly, Salary, Tips, Bonus, Commission, etc.

|

| Employee (EE) Taxes |

- Please ensure the amounts are broken out by each individual employee tax for each employee

- Ex. Federal Income Tax, State Income Tax, Social Security, Medicare, etc.

|

| Employer (ER) Taxes |

- Please ensure the amounts are broken out by each individual employer tax for each employee

- Ex. Federal Unemployment Insurance (FUTA), State Unemployment Insurance (SUI), Social Security, Medicare, etc.

|

| Benefits/Deductions (and contributions) |

- Please ensure the amounts are broken out by each individual benefit and/or deduction

- Ex. Child Support, 401K, Roth 401K, Pre-tax Medical Insurance, Post-tax AFLAC, etc.

- NOTE: Please confirm and identify which benefits are pre-tax vs post-tax

|

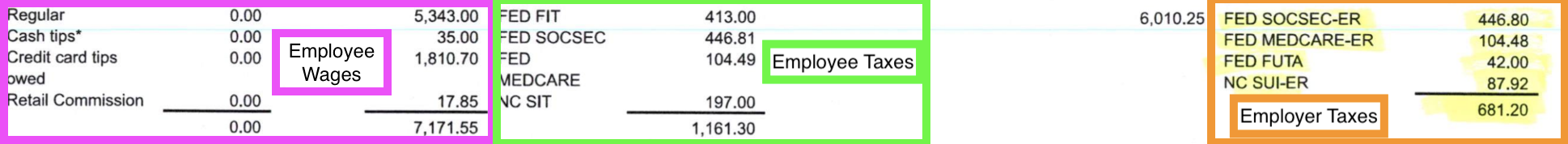

Below is an example of a report that includes the required details of an employee's wages along with employee + employer taxes.

Requesting an Implementation

Once all the items above have been completed and the required reports are reviewed to ensure they include the required data, send an email to payroll@hellopaid.com with the information below:

- Employer’s pay group and desired first payroll run date (that is at least 5+ business days out)

- Attachments of the required reports

- Any additional or clarifying information

Please don't hesitate to contact our Support team if you have any questions!

Comments

0 comments

Please sign in to leave a comment.